After over 15 years of rapidly expanding economic and political exchanges, China-Africa relations are changing.

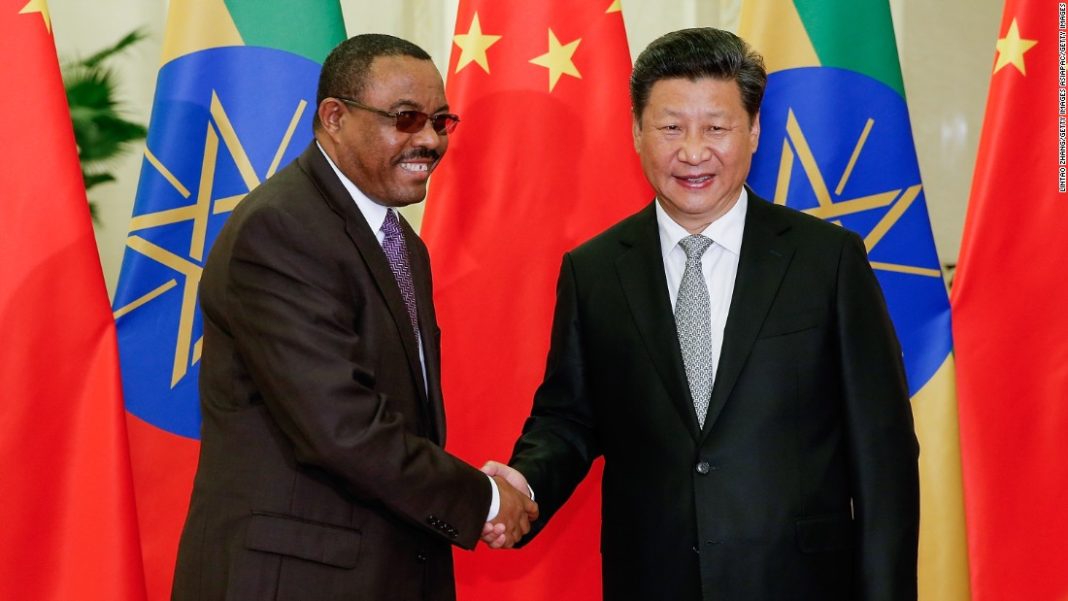

During the sixth Forum on China-Africa Cooperation (FOCAC) in Johannesburg in 2015, China’s President Xi Jinping announced 10 major China-Africa cooperation projects. Covering areas such as industrialization, agricultural modernization, infrastructure, environmental issues, and financial services. With funding for such projects amounting to around US$60 billion, a number of them are already well underway.

The forum reflected the conventional interpretation of Sino-African relations since the early 2000s. China aids Africa’s development through the construction and modernization of local infrastructure and financing apparatus. In return, Africa provides China with a steady supply of natural resources.

Shifting trends, however, are changing the current status quo. A closer look at China-Africa economic relations reveals that investment and trade flows are perhaps not as one-sided as it is commonly portrayed. Indeed, for African companies and entrepreneurs seeking to expand overseas, China is progressively becoming a destination of choice.

China’s investment destinations in Africa

In terms of foreign direct investment (FDI), China’s presence in Africa is undeniable. Between 1998 and 2012 alone, approximately 2,000 Chinese firms invested in 49 different African countries. In 2014, these investments , with South Africa, Algeria, Nigeria, and Zambia as the leading destinations.

While this may account for a fraction of the total stock of FDI in Africa when compared to that of the UK, France, and the US, the growth of China’s FDI in the continent is remarkable and the amount is impressive in relation to its own level of investment in other countries.

Sub-Saharan Africa in particular garners significant attention from China thanks to its wealth in natural resources. In 2013, China became the top destination for Sub-Saharan African exports (over US$20 billion) and the largest exporter to Sub-Saharan Africa, according to the World Integrated Trade Solution (WITS) database.

According to Yuusuf Moossajee, Partner at Moollan & Moollan, Dezan Shira & Associates’ partner firm in Mauritius, China has clearly become a leading investor in Africa. In addition to the countries mentioned above, other attractive into Africa are Egypt, Mozambique, Morocco, Côte d’Ivoire, Angola, Kenya, Senegal, and Cameroon.

In Tanzania, for example, China has become the second largest foreign investor, with Chinese MNEs having invested US$2.5 billion in about 500 projects, 70 percent of which are in manufacturing. There are currently around 20,000 businesspeople from China, who are operating in different sectors in rural and urban areas across Tanzania.

Moossajee adds that Mauritius, which has signed investment promotion and protection agreements (IPPAs) with 15 African member states, has successfully positioned itself over the years as the preferred platform for investing into Africa. There is rising interest from Chinese multinational corporations to set up their headquarters and treasury management activities in the Mauritius International Financial Center.

Areas of Chinese investment in Africa

China contributes not only to local infrastructure through buildings and industrial zones, but also to the physical integration of African states through regional projects in the form of roads, railways, waterways, energy infrastructure, and others.

This can be seen through the 2015 African Union-China memorandum of understanding to cooperate on major infrastructure and industrialization projects, which represents another step toward the African Union’s Agenda 2063 to have world class infrastructure throughout the continent.

Notable examples include the Merowe Hydropower Dam Project in Sudan, completed in 2009, the West-East Expressway in Algeria linking the North African countries, completed in 2014, and the Ethiopia-Djibouti Railway Project, completed in September 2016.

All of these projects were overseen by Chinese state-owned enterprises (SOEs) such as the China International Water and Electric Corporation and the China Civil Construction Corporation, while at least partly financed by Chinese banks.

READ:What Makes China’s Economic Achievements Suited for Africa

In contrast with Chinese SOEs, private small and medium enterprises (SMEs) focus on services sectors over infrastructure and resources-related projects. In a 2015 analysis of the Chinese Ministry of Commerce (MOFCOM) database, International Monetary Fund (IMF) economist Chen Wenjie noted that out of 3,989 projects, 60 percent of all projects were in the services sector, and within that, the business services sector received the most deals (1,053 projects).

This is true for most African countries regardless of their abundance in natural resources. For instance, two-thirds of Chinese projects in both Nigeria and South Africa are in services sectors. Manufacturing-related investment, however, is far less pronounced. Overall, while it seems that Chinese investment is heavily skewed in favor of natural resource projects when looking at aggregate data and the financial gains involved, other sectors are certainly not ignored – and may develop over time at a faster rate than SOE projects.

The rise of Africa’s manufacturing sector

While Chinese investment in African manufacturing is presently low, a number of factors suggest future expansion. At the same time, changes in demographics will temper China’s need for natural resources, resulting in a significant decrease in the pace of China’s investments into Africa’s natural resource sector.

China and Africa’s demographics are moving in opposite directions: China’s population is rapidly aging, while Africa’s fertility rates are high, with half of the continent’s population below the age of 20. UN data forecasts a decrease in the working age population in China from 927 million in 2015 to 838 million by 2035, whereas Africa’s working population could increase from 536 million to 922 million over the same period.

China will need to create fewer and fewer jobs while Africa will be required to create 20 to 30 million jobs every year in the years to come. A smaller population and labor force in the future, in addition to a slowing construction boom, may mean lower demand in China for natural resources However, a second change to note is the progression of wages in China, especially pronounced since 2012.

An increase in wages could in fact result in an increase in consumption per capita due to lifestyle changes, and a greater need for resources. Nevertheless, while its appetite for energy and resources in the 2000s largely explained China’s risk-taking approach in its African investments, China will most likely be more selective with its projects in the future.

In contrast, wages in countries such as Ethiopia and Tanzania have remained at relatively low levels. With the and shift to a services-driven economy, China may increasingly relocate its manufacturing to Africa. Ethiopia, for example, recently attracted 15 Chinese investment projects in textiles and electronics through modernizing its industrial zones and creating special economic zones, displaying the potential for such changes.

In China: African business

Sino-African trade flows are no longer a one-way street. According to the China-Africa Economic and Trade Cooperation White Paper, Africa’s FDI in China totaled over US$14 billion by the end of 2012, including US$1.4 billion in that year alone, with countries such as Mauritius, Seychelles, South Africa, and Nigeria investing in petrochemical industries, manufacturing, and wholesale and retail in China.

According to Moossajee, success stories are already abundant, such as the case of Snow Beer, the world’s best-selling beer, which

The development initiatives directed by China should foster industrialization and human capital on the African continent, which should in turn encourage the development of more added-value goods and services – to be delivered primarily in China. For instance, the 2015 FOCAC Action Plan aims to boost China-Africa training and education opportunities, with 2,000 degree programs and 30,000 government scholarships available for African students who wish to study in China.

In the past few years, ambitious African companies from a wide range of sectors have looked to expand into China, with a number of large investors originating in South Africa, for instance. Aspen Pharmacare Holdings, a South African pharmaceuticals manufacturer, has increased its exports by two-thirds in 2016 and has used its recent acquisitions of pharmaceutical product lines to boost its number of sales representatives in China to over 600 people. Its Chinese sales force is now the company’s biggest worldwide.

Chemical and energy giant Sasol, also from South Africa, is currently looking to strengthen its position in the growing Chinese market through a new alkoxylation plant in Nanjing, whose construction began the June 8 this year. The plant will allow the firm to meet differentiated customer requirements, such as personal care, detergent, textiles, and other categories.

Naspers, the initially small South African newspaper publisher, failed to expand in China in the 1990s through a subsidiary, yet broke through in 2001 with a US$32 million investment into Tencent, at the time a loss-making tech start-up. The latter’s success catapulted Naspers into a multimedia investing powerhouse and the seventh largest Internet company in the world. Its 34 percent share in Tencent is now worth roughly US$100 billion.

African commercial activity in China is also thriving at a local level. In Guangdong, the manufacturing heart of the country, hubs such as Guangzhou’s Yuexiu and Baiyun districts are flourishing with small African businesses.

Trading is the main line of work for many in China to purchase inexpensive goods from wholesale markets, shops, and factories throughout the country to sell them back in Africa. The goods sourced in China by African traders are mainly textiles, cosmetics, and electronic products. A number of business-people are also present to act as intermediaries between investors in African and Chinese factories.

A shifting china-Africa relationship

While the China-Africa trade relationship was primarily defined in the recent past as infrastructure and development in exchange for natural resources, the trends are changing. The shift in demographics should dampen China’s demand for natural resources, while rising wages in China should encourage the shift of manufacturing capabilities to Africa. Eventually, African labor in China-funded infrastructure projects in Africa could become more attractive than exporting Chinese labor.

As seen, a number of African enterprises, especially joint ventures, are taking off in China. The primary challenge that remains for these newcomers, however, is adapting to an unfamiliar business environment, from the complex regulatory environment to competition with local players.

While the China-Africa economic relationship is just beginning to shift, opportunities are emerging for forward-looking investors mindful of these macro-economic changes.

This article was first published on China Briefing.The Writer Linh Tran Huy is International Business Advisory Assistant at Dezan Shira & Associates.