As 2025 draws to a close, the construction industry finds itself at a critical inflection point.

The year began with cautious optimism but quickly evolved into a story of resilience amid volatility—one marked by cooling growth, persistent workforce challenges, and unprecedented technological transformation.

For contractors, developers, and industry stakeholders, 2025 has been a year that demanded adaptability, strategic thinking, and a willingness to embrace change.

The Economic Reality: Growth Stalls Amid Uncertainty

The construction sector’s performance in 2025 can best be characterized as a tale of two halves. Early momentum gave way to sobering challenges as the year progressed, with total construction spending plateauing after years of growth.

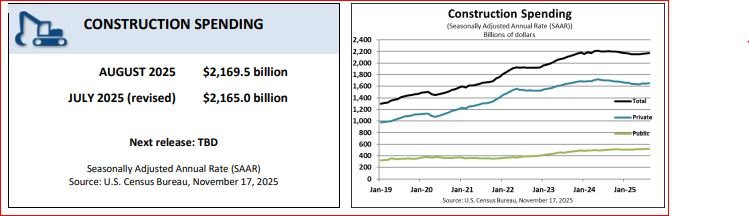

According to the U.S. Census Bureau, construction spending reached approximately $2.17 billion at a seasonally adjusted annual rate by August 2025, representing only modest growth compared to 2024.

More tellingly, the year saw eight consecutive months of declining construction spending from January through August, primarily driven by elevated interest rates and policy uncertainty that dampened investment appetite.

Real value added in the engineering and construction sector climbed to $890 billion in the second quarter—a mere 1% increase year-over-year—while real gross output actually fell by 0.6%.

By July, total construction spending had declined almost 3% year-over-year, with commercial construction down 8.2% and manufacturing construction falling 7%.

“This is still a fairly robust market,” noted Richard Branch, chief economist at Dodge Construction Network, though he acknowledged the headwinds facing the sector.

The overall forecast painted a picture of modest growth tempered by significant challenges. Total construction put-in-place spending was projected to reach $2.23 trillion in 2025, representing just a 3.3% increase from 2024—a far cry from the robust 6.6% growth seen in the previous year.

Jay Bowman, partner at FMI Consulting, expressed measured optimism: “I know there’s a lot of negative talk out there regarding inflation and labor shortages, but I think the industry is doing pretty good, all things considered.”

However, he cautioned that viewing construction as a monolithic entity is misleading. “This idea that there’s this one U.S. construction industry is misleading,” Bowman said, noting that FMI tracks 19 different segments moving in different directions.

Sector Performance: A Divided Landscape

One of 2025’s defining characteristics was the stark divergence in performance across construction sectors. While some segments struggled, others experienced extraordinary growth, creating a fragmented market landscape.

The Data Center Phenomenon

The undisputed star of 2025 was data center construction, driven by the explosive growth of artificial intelligence and cloud computing.

After increasing by more than 50% in 2024, data center spending surged another 33% in 2025, with projections for an additional 20% growth in 2026. This unprecedented expansion transformed data center construction from a niche segment into a major industry driver, with firms specializing in this sector reporting robust backlogs well into 2026.

Branch highlighted the significance of data centers and high-tech manufacturing projects, noting their need for added power sources as a positive for the industry.

The AI race fueled intense competition among tech giants to build computing capacity, creating opportunities for contractors with expertise in power infrastructure, cooling systems, and specialized electrical work.

Infrastructure: The Steady Performer

Civil engineering and infrastructure construction remained the industry’s backbone, benefiting from ongoing federal investment through the Infrastructure Investment and Jobs Act.

This segment was forecast to grow 3.4% in 2025 and an additional 5.5% in 2026, driven by sustained government spending on transportation, renewable energy, broadband expansion, and water systems.

“This is the era of the megaproject, and future prospects are quite positive for contractors who are able to participate in major public works,” said Anirban Basu, chairman and CEO of Sage Policy Group.

Basu noted that much construction activity is being driven by the reemergence of industrial policymaking in America, an economic transformation that has led to programs such as the Inflation Reduction Act, the CHIPS and Science Act, and the IIJA.

Highway construction spending stood at $142.5 billion by August, while educational construction reached $112.6 billion.

Public infrastructure projects provided a crucial buffer against weakness in private sector construction, with public spending up 3.4% while private bids declined 3.8% compared to 2024.

Residential Construction: Affordability Crisis

The residential sector faced persistent headwinds throughout 2025. High interest rates—which remained elevated for much of the year despite late cuts—continued to constrain housing affordability and dampen demand.

Single-family construction saw particular weakness, while multifamily residential construction declined an estimated 7% to $131 billion.

The residential sector’s struggles reflected broader economic anxieties, with potential homebuyers sitting on the sidelines amid concerns about mortgage rates, home prices, and economic uncertainty.

However, pockets of growth emerged in affordable housing projects and developments tied to infrastructure corridors.

Commercial Real Estate: Office-to-Residential Conversions

Traditional commercial construction experienced one of the most challenging years in recent memory, declining 13.3% year-over-year by September.

The remote work revolution’s lasting impact left office vacancy rates approaching 20% nationally, fundamentally altering demand patterns.

Kermit Baker, Chief Economist for the American Institute of Architects, acknowledged that office construction remains historically the weakest category in commercial construction, though he noted that manufacturing, warehouses, and data centers have had an outsized impact on overall non-residential building market trends.

In response, office-to-residential conversions nearly doubled in 2025, demonstrating the industry’s creative adaptation to changing market conditions.

Developers increasingly pursued mixed-use projects that combined residential, retail, and office components, hedging against single-use obsolescence.

Manufacturing: The Retreat

Perhaps the most surprising reversal came in manufacturing construction. After serving as a significant growth engine in 2023 and 2024—driven by reshoring trends and the CHIPS Act—manufacturing construction spending declined 2% in 2025, with an additional 2.6% drop projected for 2026.

This slowdown reflected broader economic uncertainty, trade policy concerns, and companies reassessing expansion plans in light of cost pressures.

The Labor Crisis Deepens

If 2025 will be remembered for one persistent challenge, it’s the labor shortage that continued to plague the industry throughout the year.

The workforce gap not only constrained project capacity but also drove significant wage inflation and contributed to project delays across virtually every sector.

“If you’re a builder, particularly a nonresidential builder, what this indicates is that your main challenge in 2025 will continue to be finding workers to do the work,” Basu told Construction Dive in January.

By mid-2025, the industry needed to hire approximately 439,000 new workers on top of normal hiring just to meet demand—a staggering figure that highlights the scale of the challenge.

“While the construction workforce has become younger and more plentiful in recent years, the industry still must attract 439,000 new workers in 2025 to balance supply and demand,” Basu explained.

“If it fails to do so, industrywide labor cost escalation will accelerate, exacerbating already high construction costs and reducing the volume of work that is financially feasible.”

Looking ahead to 2026, this gap was projected to widen to 499,000 workers, creating what industry leaders characterized as an existential threat to growth. Construction wages increased 4.2% year-over-year through August 2025, with average hourly earnings up 4.4% over twelve months—significantly outpacing earnings growth across all industries.

Industry analysts estimated that if labor shortages persisted, the sector could lose nearly $124 billion in construction output due to unfilled positions.

The situation was particularly acute in skilled trades. Ken Simonson, chief economist for the Associated General Contractors of America, emphasized the severity of the crisis: “Construction workforce shortages aren’t just a problem for the construction industry—they’re causing delays across every sector that depends on new buildings and infrastructure.”

According to AGC’s 2025 Workforce Survey, 92% of construction firms reported having a hard time finding workers to hire. More alarmingly, 45% of respondents experienced project delays due to shortages of their own or subcontractors’ workers.

Overall, 78% of firms reported experiencing at least one project that had been delayed during the past twelve months.

Simonson noted that federal officials have failed to properly invest in construction workforce training and education.

“The biggest takeaway from this year’s Workforce Survey is how much the nation is failing to prepare future workers for high-paying careers in fields like construction,” he said. “It is time to rethink how the nation educates and prepares workers.”

The survey revealed that 57% of firms report available candidates are not qualified to work in the industry because they lack essential skills or do not have an appropriate license for the position.

The National Center for Construction Education and Research estimated that 41% of the construction workforce will retire by 2031, compounding the challenge.

Immigration policy changes implemented during 2025 exacerbated these challenges. Twenty-eight percent of respondents reported being affected directly or indirectly by immigration enforcement activities during the past six months.

Construction proved disproportionately more dependent on foreign-born labor than many peer industries, making it especially vulnerable to policy shifts.

“41% of the construction workforce will retire by 2031”

Basu identified two major factors compounding the construction labor shortage. The first is the cyclical nature of the economy, where demand rises and falls.

“The other factor is that the U.S. hasn’t educated and produced enough blue collar workers in recent years for jobs in industries like construction and manufacturing,” he noted, though he expressed optimism that this could shift as more people gradually consider and pursue in-demand jobs in the trades.

Cost Pressures: Tariffs and Materials

Material cost inflation provided another major headwind throughout 2025. While prices had stabilized somewhat from the peaks of 2022-2023, they remained well above pre-pandemic levels and faced new upward pressure from tariff policies.

Anthony Johnson, CEO of Clayco, summarized the challenges facing the industry: “In the second half of 2025, we’re closely watching persistent cost volatility, high demand and continued constraints in lending. These forces are making clients more cautious, and rightfully so.”

The effective tariff rate for construction goods climbed to a 40-year high of 25-30% in 2025, with specific materials like steel and aluminum facing tariffs reaching up to 50%. These increases sharply raised construction material costs, with prices rising steadily from May through August.

Branch acknowledged that while policy changes could benefit contractors through tax cuts and reduced red tape, “tariffs could also pose an issue, as they have the potential to raise costs.”

He noted that legislative and executive actions take time to ripple through the economy, meaning impact on the sector would likely be felt in the second half of the year.

The financial impact proved severe for an industry operating on notoriously thin margins. The ripple effects extended beyond immediate cost increases—procurement delays became commonplace as suppliers adjusted to the new tariff regime, and project budgets required constant revision.

The consequences were stark: project abandonment activity surged 88.2% year-over-year in August 2025, a dramatic increase that reflected developers revisiting budgets and adjusting financial projections in response to cost escalation.

By May, overall construction project abandonments had spiked 30.3%, signaling widespread project viability concerns.

The Digital Transformation Accelerates

Against this backdrop of economic challenges, 2025 marked a watershed year for technology adoption in construction.

What had been gradual digitalization became rapid transformation as firms recognized that technology offered one of the few paths to overcoming labor shortages and cost pressures.

AI and Machine Learning Take Center Stage

Artificial intelligence moved from experimental to essential in 2025. Survey data revealed that 68% of construction businesses were either already leveraging or actively planning to implement AI technologies—a remarkable acceleration from previous years.

“AI will redefine construction operations in 2025, offering smarter planning, resource allocation, and on-site execution,” predicted industry observers. The technology promised to minimize risk, increase safety, reduce repetitive tasks, and keep operations on schedule.

Kasey Bevans, Balfour Beatty US chief information officer, described the company’s StoaOne AI assistant: “To our teammates, it will feel like StoaOne is talking to them, providing instant insights and project information as they procure, plan and execute their projects.”

The platform mines what Bevans characterized as untold billions of data points to help employees work more efficiently.

Swedish contractor Skanska developed Sidekick, a generative AI chatbot built on ChatGPT technology to help employees access the firm’s collective expertise. The platform saw over 2,500 interactions during a 30-day period, demonstrating strong adoption among users.

Mark Webster, senior vice president and general manager at Oracle Construction and Engineering, emphasized AI’s transformative potential: “The integration of AI and modular construction methods can help contractors, subs, suppliers and their partners maximize profitability and productivity.

This shift can also help lead to more successful projects that are delivered on time and within budget.”

Dr. Giovanna Brasfield of Brasfield & Associates predicted: “In 2025, AI will be widely utilized beyond just Generative AI and will be used to track and detect non-compliance of safety measures on the field/site.

It will also be used to identify site progress and streamline reporting as it continues to improve in accuracy due to increase in the quality of data collection.”

René Morkos, founder and CEO of ALICE Technologies, highlighted AI’s impact on scheduling: “AI technology can now help contractors create and test various different construction schedules to find the most efficient way to build.”

He described a process called construction optioneering, through which schedule options can be simulated to test the impact of different variables.

However, Morkos cautioned that AI isn’t a magic bullet. “Its effectiveness depends on the quality of data it receives. The technology can’t fix disorganized processes, scattered input or disconnected teams.”

The Adoption Challenge and Competitive Pressure

Not everyone embraced the technology with equal enthusiasm. Chad Prinkey, CEO of Baltimore-based Well Built Construction Consulting, offered a stark warning to small contractors: “It’s time to get big or strongly consider an exit very shortly.

If you’d rather spare yourself the hassle of growth, consider selling as close to now as possible. Prices for small firms will diminish as the gap in sophistication between them and their acquirers grows.”

Jason Barrett of Turner Construction echoed a popular industry refrain: AI won’t take a worker’s job, but the person who uses AI will.

“The same is true of companies, in that a builder that uses AI will disrupt the business of a builder that doesn’t,” Barrett said.

“What I see in our industry and other industries is caution, almost fear, imagining all these scenarios of things that could go wrong. If you want zero risk, you also have zero opportunity.”

Bevans agreed on the strategic importance: “We also know that adopting new technologies and implementing them in our operations differentiates ourselves so we can significantly change the construction industry.”

Mark Cotton, Chief Information Officer with UK construction firm Galliford Try, pushed back on the narrative of construction lagging in digital adoption: “I often see construction being quoted as backward at digital; I take exception to that.

We are engineers and problem solvers with some extraordinarily bright people in our business who know how to utilize technology to its maximum.”

Yves Padrines, CEO of Nemetschek Group, which provides software to architecture and construction firms, emphasized the urgency: “90% of projects are late, 40% of CO2 emissions come from the construction industry, there is a huge shortage of manpower, so being more efficient is key.

We need a big productivity gain as there are seven million employees missing in construction.”

Building Information Modeling and Beyond

Building Information Modeling achieved mainstream status in 2025, with adoption expanding beyond large contractors to mid-sized firms. The technology’s ability to reduce project timelines by up to 50% while cutting costs by 52% made it essential for competitive bidding.

While only about 55% of firms used robotics at year’s beginning, adoption accelerated rapidly throughout 2025 as pilot programs demonstrated up to 50% productivity gains alongside significant safety improvements.

Robotic systems handled repetitive tasks like bricklaying, welding, and material transport, freeing human workers for more complex activities requiring judgment and creativity.

Drone technology became ubiquitous on construction sites, generating detailed site maps and progress documentation. Cloud-based project management platforms enabled real-time collaboration across dispersed teams, keeping projects on track while reducing administrative overhead.

Digital leaders in construction reported spending two hours less per week on data management tasks compared to their peers, freeing up 5% more time for higher-value work.

However, challenges remained—the median construction business used 11 different data environments, creating integration headaches.

Technology investment surged in response to these opportunities. According to industry surveys, 44% of contractors planned to increase investment in artificial intelligence, while 26% intended to boost spending in BIM in 2025.

Merger and Acquisition Activity Surges

The challenging operating environment drove significant M&A activity in 2025, as firms pursued inorganic growth strategies to build scale, expand capabilities, and access new markets.

Construction M&A activity expanded 33.8% year-over-year, rising from 272 deals to 364 deals through the year.

The majority—73.4%—of this growth stemmed from financial buyers, with private equity firms increasingly viewing construction as an attractive investment opportunity given infrastructure tailwinds and essential service characteristics.

Deal value reached $33 billion in Q3 2025 alone, up 49% year-over-year, with $23 billion coming from mega-deals valued at $1 billion or more.

These large transactions returned to the market after a cautious start to the year, signaling renewed confidence among major players.

Strategic Drivers and Notable Transactions

Several factors drove M&A activity in 2025: technology acquisition, geographic expansion, data center expertise, scale and efficiency, and vertical integration. Firms increasingly acquired companies to gain digital capabilities rather than building them internally.

Notable deals reshaped the competitive landscape. Herc Holdings’ $5.3 billion acquisition of H&E Equipment Services significantly consolidated the North American equipment rental market.

Quanta Services acquired CEI, one of the largest electrical contractors in the U.S., creating a combined entity with comprehensive end-to-end electrical infrastructure solutions.

Parsons acquired BCC Engineering for $230 million, targeting the company’s strong presence in the high-growth Southeastern U.S. infrastructure market.

Private equity’s construction sector presence continued expanding. PE backing enabled aggressive growth strategies and technology investments that bootstrapped firms couldn’t afford, though PE’s focus on exit timelines sometimes created pressure for short-term performance.

Sustainability and Green Building

Environmental considerations moved from peripheral concern to core business driver in 2025. The construction industry’s contribution to global carbon emissions—approximately 40% of total CO2 emissions—came under increasing scrutiny from regulators, investors, and clients.

Federal funding for infrastructure increasingly tied to environmental performance goals, with sustainability requirements and energy efficiency standards shaping project designs.

Net-zero buildings gained popularity, with adoption of eco-friendly materials and sustainable sourcing becoming standard practice rather than premium options.

Green building certifications like LEED became table stakes for many commercial and institutional projects. Climate resilience also gained prominence, with buildings designed to withstand extreme weather events and natural disasters.

Looking Ahead: 2026 and Beyond

As 2025 closes, industry leaders face 2026 with tempered optimism. While significant challenges persist, several factors point toward potential improvement.

Late 2025 saw the beginning of interest rate reductions, with further cuts expected in 2026.

Michael Guckes, ConstructConnect’s Chief Economist, noted that of nearly 30 different types of U.S. commercial construction tracked, nearly 75% are expected to experience strong growth in the coming year.

This growth is driven by a predicted 56% increase in military project spending, an almost 28% rise in hotel projects, and a projected 25% increase for shopping and retail.

“Part of that is just a turnaround story,” Guckes explained. “The military sector really struggled this year, and hotels and motels had a similar experience. Some areas where we saw weaknesses in 2024 are expected to see strong rebounds in 2025.”

Federal infrastructure spending through the IIJA will continue providing a strong foundation for civil construction, with billions in unspent funds still in the pipeline.

The industry’s accelerating technology adoption should begin yielding measurable productivity improvements that help offset labor shortages and cost pressures.

Years of underbuilding in residential construction have created significant pent-up housing demand that should support activity once financing conditions improve.

The shift toward renewable energy and electric vehicles will drive continued investment in power generation, grid infrastructure, and supporting facilities.

However, significant risks remain. The workforce gap shows no signs of closing quickly, and immigration policy uncertainty threatens to exacerbate rather than alleviate pressure. Tariff policy uncertainty could trigger renewed material price inflation, particularly if trade tensions escalate.

Economic recession risk hasn’t disappeared entirely, and changes in federal spending priorities could significantly impact construction activity.

Conclusion: Resilience Through Transformation

The construction industry’s 2025 performance reflects both the sector’s inherent challenges and its capacity for adaptation.

While traditional metrics like spending growth and project starts paint a picture of modest performance, the year’s true significance lies in the transformation underway beneath the surface numbers.

Construction firms emerged from 2025 more technologically sophisticated, more strategically consolidated, and more attuned to workforce and sustainability imperatives than ever before.

The industry demonstrated that even amid economic headwinds, innovation and strategic thinking can drive progress.

The data center boom, infrastructure investment resilience, and successful pivot to office-to-residential conversions showcased the sector’s ability to identify and capitalize on new opportunities.

The acceleration of digital transformation—driven by necessity but yielding genuine competitive advantage—positions early adopters for long-term success.

As Barrett of Turner Construction noted, standing still is not an option. The firms that will thrive in the years ahead are those that used 2025’s difficulties as a catalyst for fundamental transformation.

The question isn’t whether conditions will improve—it’s whether companies built the capabilities to capitalize when they do.

For those who embraced change rather than merely enduring it, 2025 will be remembered not as a year of disappointment but as a turning point—the moment when construction transformed from a traditional, analog industry into a technology-enabled, strategically sophisticated sector ready for the demands of the 21st century.

Also Read

The Biggest Public Transit Projects Transforming American Cities in 2026

The Biggest Construction Projects Driving Job Growth in the U.S. in 2026