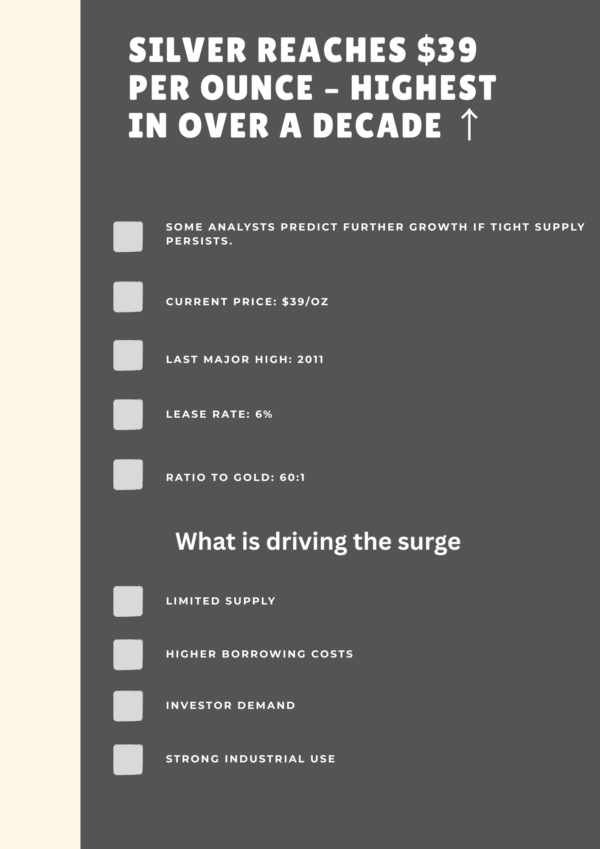

Silver has officially extended its impressive 2025 rally, reaching nearly $39 per ounce — a level not seen since 2011.

The surge, which has surprised many in the commodities market, is being attributed to a confluence of factors: tightening physical supply, rising lease rates, and a growing investor appetite for undervalued precious metals.

As gold sits near record highs, silver is now emerging as the alternative haven, drawing increased attention from institutional investors, retail traders, and industrial stakeholders.

What’s Driving the Silver Rally?

1. Tight Physical Market Conditions

At the heart of silver’s surge is a tightness in physical supply, particularly in London, the world’s key trading hub for the metal.

Silver-backed ETFs have seen steady inflows in recent months, locking up physical silver and reducing the amount available in the spot market.

“We’re seeing classic signs of stress — higher leasing rates, backwardation in the market, and increasing delivery premiums,” said a metals strategist from a leading London brokerage.

Increased demand from both investors and industrial users has collided with reduced mine output and limited above-ground stockpiles, triggering a supply squeeze.

2. Soaring Lease Rates Signal Stress

2. Soaring Lease Rates Signal Stress

Silver’s implied one-month lease rate has climbed above 6% annualized, a dramatic rise compared to near-zero levels earlier this year.

These borrowing costs reflect the price traders pay to “lease” silver for short-term trades — and they’re often viewed as a barometer of physical scarcity.

Such levels haven’t been seen since previous market dislocations, reinforcing the notion that available silver in key markets is under stress.

3. Rotation from Gold to Silver

With gold trading around $2,400 per ounce, many investors are viewing silver as the undervalued cousin of the precious metals family.

Historically, the gold-to-silver ratio (currently hovering around 60:1) suggests silver remains underpriced relative to gold.

This has prompted a strategic rotation from gold to silver, especially among hedge funds and large institutional buyers looking to capitalize on silver’s upside potential.

Comparing to the 2011 Silver Surge

The last time silver traded at these levels was in April 2011, when it briefly touched $49.80 per ounce amid inflation fears and dollar debasement concerns. While the 2011 rally was largely speculative, today’s market is underpinned by stronger fundamentals:

-

Industrial demand from electric vehicles, solar panels, and electronics is booming.

-

Green energy policies are accelerating silver usage in photovoltaics.

-

Monetary policy uncertainty continues to drive safe-haven buying.

Implications for Investors and Industries

For Investors

-

Silver ETFs like SLV are seeing renewed inflows.

-

Miners and producers may benefit from rising margins.

-

Speculators should watch for volatility; high lease rates can signal temporary dislocations.

For Industrial Users

-

Manufacturers in solar, automotive, and electronics could face higher input costs.

-

Some buyers may need to secure long-term supply contracts to avoid price shocks.

Is There More Room to Run?

Analysts remain divided. Some believe silver has room to test $45–$50 per ounce, especially if physical markets remain tight. Others warn that if lease rates normalize and ETF demand wanes, the rally could cool.

“We’re in a structural bull market for silver, but don’t expect a straight line,” cautioned a commodities analyst at JPMorgan. “Volatility is the price of opportunity.”

Conclusion: Silver Shines Again

Silver’s surge to near a 14-year high is more than just a short-term spike — it reflects deeper supply-demand imbalances, growing industrial relevance, and shifting investor sentiment.

While volatility is likely to remain high, the metal’s strategic role in both finance and industry suggests that silver’s comeback story is just beginning.

Also Read

Should You Buy MicroStrategy Instead of Bitcoin? Here’s What Analysts Think

XRP’s Path to $10: Why This Crypto Veteran Thinks the Market Is Underestimating Ripple