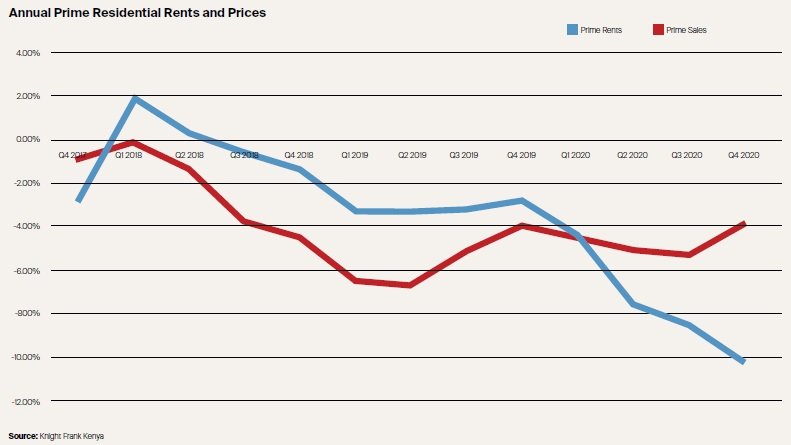

The residential sector remained a buyers’ market in 2020, as prime residential rents declined sharply by 10.25%, compared to 2.8% in 2019, according to Knight Frank’s Kenya Market Update for the second half of 2020.

Notably, this was attributed to the continued oversupply of rental properties, less disposable income due to the unfavourable economic climate brought about by the pandemic, budget cuts from multinationals and fewer expatriates in the country.

These factors also affected sale prices of prime residential properties in Nairobi, which decreased by 3.9% in 2020, compared to 4% in 2019.

Ben Woodhams, Managing Director at Knight Frank Kenya, said: “Although there’s been a downward trend of prime rents and sale prices, there was increased market activity in the second half of 2020, as landlords, developers and sellers, aware of the economic situation, became more flexible and were willing to negotiate lower prices with potential buyers and tenants.”

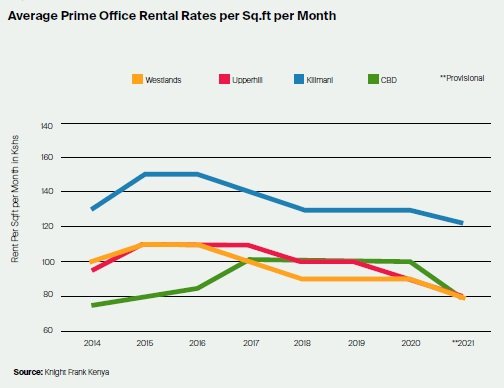

In the commercial office market, absorption of Grade A and B office space decreased by 50% in the review period, compared to a similar period in 2019, with overall absorption for the year 2020 declining by 47%

Rents of prime commercial offices in Nairobi decreased from US$1.3 per square foot (sq. ft) per month to US$1.12 per sq. ft per month in the second half of 2020. Average occupancy rates across commercial buildings at the end of the year were at circa 72%.

The Kenya Market Update – 2nd Half 2020 notes that the decline in office uptake and rental values is mainly attributed to the continued oversupply of commercial space in some locations and unfavourable economic conditions, which resulted in majority of occupiers halting their space requirements as staff worked remotely.

Similar to the first half of 2020, the retail sector remained one of the hardest hit sectors due to the pandemic. Though retail occupancy declined, prime retail rents remain unchanged over the review period at US$4.2 per square foot (sq. ft) per month as a result of retailers upgrading to spaces previously taken up by struggling businesses.

Grocery retailing bucked this trend, however, with this newest part of the sector remaining one of the most active in the review period, as neighbourhood supermarkets and more convenience-focused malls saw increased demand from consumers.

Also Read

South Africa publishes preferred bidders for 2 GW tech-neutral tender

Kampala-Jinja Expressway Project gets financial boost