CFDs attract serious attention in South Africa for a simple reason. The local retail trading scene tends to move fast, and it often looks outward.

Traders follow global macro themes, track commodity-linked currencies, and watch offshore equity indices with the same focus they give local headlines.

CFDs fit that mindset because they offer flexible access to international instruments without forcing a trader to switch between many different account types.

That flexibility creates a clear tradeoff. CFDs reward preparation and punish sloppy process. South Africa’s market culture, along with an evolving regulatory environment, has pushed many traders toward more structured habits.

The result looks like a community that values opportunity, while also taking platform risk, leverage, and execution quality seriously.

South Africa’s retail trading culture favors speed with structure South Africa has a deep bench of retail traders who treat markets like a skill set, not a casual hobby.

Many traders here build routines around session overlaps, news windows, and liquidity peaks. That matters for CFDs because timing and execution often decide whether a short-term idea stays controlled or turns chaotic.

A common pattern shows up across active desks and retail communities. Traders use CFDs as a tactical layer rather than a long-term holding vehicle.

They look for defined setups, clear invalidation points, and fast feedback from price action. This style supports rapid iteration. It also demands clean risk controls, since leverage magnifies both good decisions and weak discipline.

CFDs also align with how many South African traders think about diversification. Exposure can rotate between FX, global indices, and commodities based on the theme of the week.

That rotation can protect a portfolio from becoming too dependent on one local narrative.

Platform reliability becomes part of the trading edge

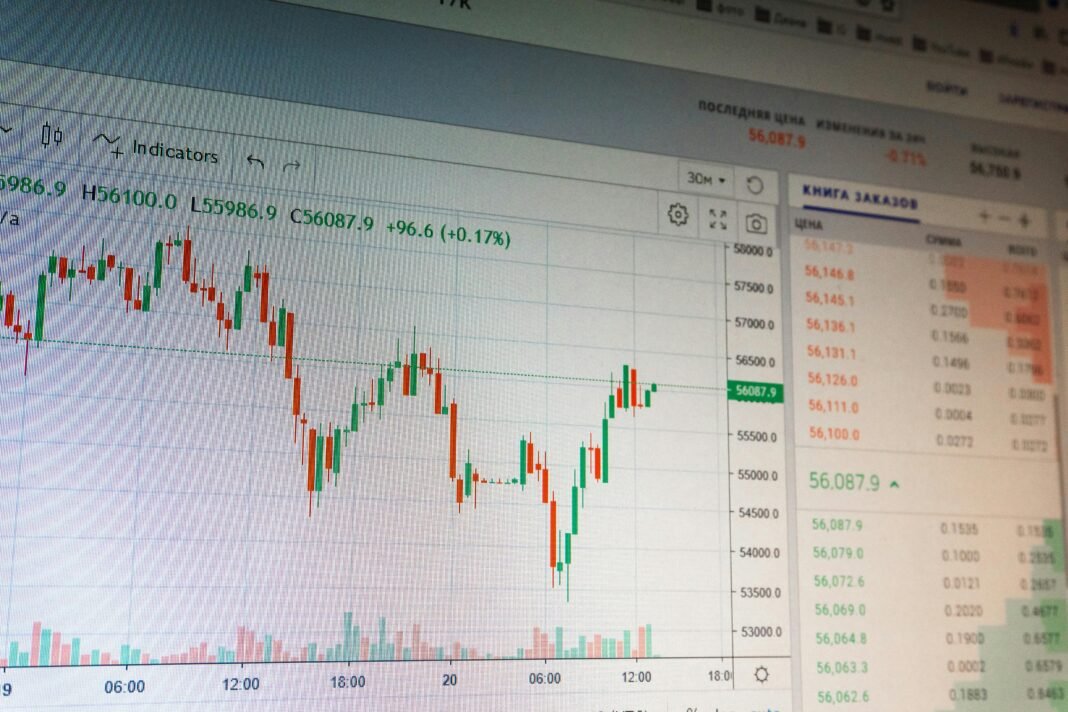

Execution quality matters in CFD trading because the platform acts as the bridge between idea and outcome.

A strong trade thesis can still fail if spreads widen unexpectedly, orders lag, or the platform freezes during volatility. This is why reliability belongs in the same category as strategy and risk rules.

Reliable platforms also support consistent decision-making. Stable charts, predictable order handling, and clear margin visibility reduce friction.

That friction matters more than it sounds. It shapes behavior. Traders who trust their tools tend to follow their plan more closely, especially when the market accelerates.

This is also where due diligence pays off. Traders often evaluate platforms using real conditions rather than marketing claims.

They test order types, review fee schedules, and check how the platform behaves during active sessions.

Many traders who look for a reliable platform for CFD trading in South Africa are comparing execution features, platform stability, and the overall trading environment. The key is to match the platform to the trading style, then validate it through consistent testing.

- Confirm the platform offers the order types needed for the strategy, then test them in live-like conditions.

- Review how spreads behave during active sessions, and during volatile news windows.

- Check margin and liquidation mechanics, since they influence how risk plays out under leverage.

- Evaluate support responsiveness, since operational issues tend to happen at the worst possible time.

Financial regulation influences how traders design their processes

Regulation shapes CFD trading less through theory and more through day-to-day expectations.

Traders who operate with longevity in mind tend to keep records, follow broker communications closely, and build plans that assume rules and product terms can shift.

This mindset reduces surprises, especially around margin, instrument availability, or changes to trading conditions.

It also changes how traders think about counterparty risk. With CFDs, the broker relationship lies at the center of the trade.

Pricing, execution, and even the ability to enter or exit during volatility depend on that infrastructure.

Local traders who pay attention to regulatory signals often take a more conservative stance on where they place capital, how they size positions, and how they respond to fast markets.

A practical way to frame regulation is to treat it as part of risk management. It sets boundaries and encourages better documentation, which supports consistency when trading becomes emotionally noisy.

- Maintain a written rule set for leverage usage and maximum loss limits.

- Keep a clean log of trades, including reasons for entry and exit.

- Review broker disclosures, margin terms, and instrument-specific conditions on a routine basis.

How South African traders use CFDs to reach global markets

CFDs offer a direct route into global market narratives.When the US dollar trends, local traders often express views through major FX pairs or commodity-linked currencies.

When risk sentiment shifts, index CFDs provide a fast way to participate without managing a full cash equity workflow. When commodities move, CFDs allow tactical exposure to energy or metals pricing that can ripple into local expectations.

This access becomes more valuable when traders pair it with a clear time horizon. Many experienced participants separate “theme trades” from “execution trades.”

A theme trade reflects a macro view, while the execution trade focuses on the exact entry, stop placement, and position management.

CFDs support that separation because they let traders express a view quickly, then manage it with precision.

Risk management tends to look different in this environment. Instead of relying on wide stops and hope, traders focus on position sizing and clean exits.

They also plan around volatility events, since sudden spreads and slippage can appear when liquidity thins.

Also Read

Bitcoin Plunges to 2026 Lows as Crypto Markets Face Sharp Selloff