The Kenyan government is taking a firm stance on loan repayment, announcing that individuals who have defaulted on their Hustler Fund loans will soon be blocked from accessing credit from any financial institution in the country.

This move signals a significant shift in the management of the popular financial inclusion fund, potentially transforming the credit landscape for millions of Kenyans.

The decision, aimed at curbing the high default rates plaguing the fund, will integrate the Hustler Fund’s borrowing data with the country’s main credit information sharing systems.

According to Cooperatives and MSMEs Cabinet Secretary Wycliffe Oparanya, this measure is necessary to instill a culture of financial accountability among borrowers.

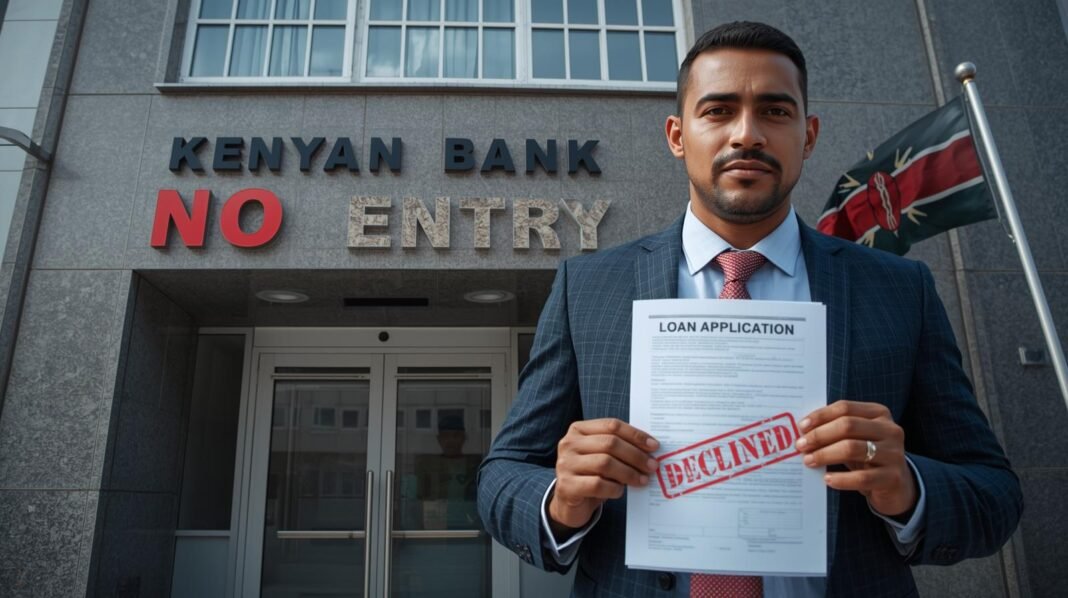

“If you have not repaid the Hustler Fund, you will be deemed ineligible for a loan when you go to any bank,” Oparanya stated during a recent address.

He explained that financial institutions will be required to check a potential borrower’s Hustler Fund status before approving any loan application.

The goal is to ensure the sustainability of the fund and to hold borrowers accountable for their financial commitments.

Since its launch in 2022, the Hustler Fund has disbursed nearly Ksh 70 billion to over 26 million Kenyans, providing critical capital for micro, small, and medium-sized enterprises.

The fund was designed to offer easy-access, low-interest loans to individuals who are typically excluded from the traditional banking sector.

However, its success has been challenged by repayment issues.

A recent report from the Kenya Human Rights Commission highlighted a default rate of over 68% by the end of 2022, a figure the government has contested, claiming a much higher repayment rate of over 83%.

This new policy is expected to have a widespread impact. For borrowers, it means that defaulting on a Hustler Fund loan, regardless of the amount, could severely damage their creditworthiness and lock them out of future financial opportunities.

Financial analysts suggest this could be a double-edged sword. While it may encourage timely repayments, it could also push defaulters further into financial exclusion if they are unable to clear their initial debt.

Financial institutions, on the other hand, will gain an additional layer of data to assess risk, potentially reducing their exposure to serial defaulters.

The integration will formalize the Hustler Fund’s role within Kenya’s broader financial ecosystem, treating its loans with the same seriousness as those from commercial banks.

The government’s strategy also includes strengthening the fund’s internal processes. The recent appointment of Henry Tanui as the new CEO of the fund is part of this initiative.

Tanui has expressed a commitment to reengineering collection processes and enhancing financial literacy programs to support borrowers in managing their debts effectively.

As this policy is rolled out, the focus will be on its implementation and the real-world consequences for the millions of “hustlers” who rely on credit for their livelihoods.

The message from the government is clear: financial support comes with responsibility, and failure to repay will now have far-reaching consequences beyond the fund itself.

Also Read

Altvest Capital to Raise $210M for Bitcoin Treasury

Microsoft Announces Phased Return-to-Office Plan for 2026