The industrial filtration landscape is undergoing a fundamental transformation. As manufacturers face increasingly stringent environmental regulations, demanding process conditions, and pressure to reduce operational costs, a clear winner is emerging: ceramic membranes.

Market analysts project the ceramic membrane sector will grow from approximately $8-10 billion in 2024 to over $20 billion by 2030-2032, with growth rates consistently exceeding 10% annually.

This remarkable expansion reflects more than just market trends—it signals a paradigm shift in how industries approach filtration challenges.

The Technology Behind the Transformation

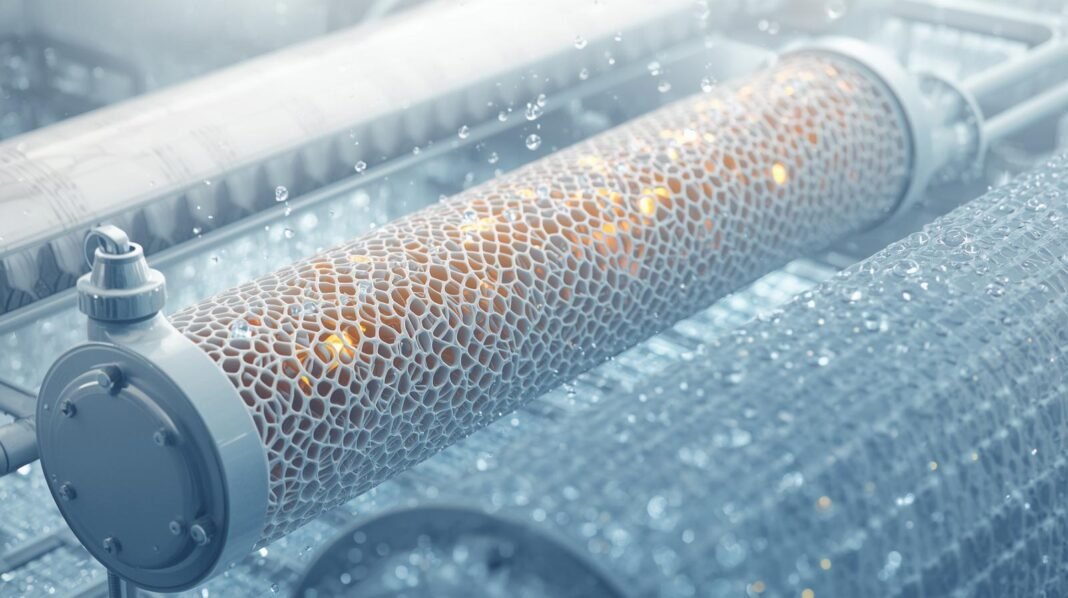

Ceramic membranes represent a sophisticated evolution in separation technology. Manufactured from inorganic materials such as alumina, titania, zirconia oxide, and silicon carbide, these filtration systems utilize cross-flow technology where wastewater passes through tubular ceramic elements with precise pore sizes ranging from 0.05 to 0.2 microns.

Unlike their polymeric predecessors, ceramic membranes operate on a fundamentally different principle.

Feed water enters the membrane channels under pressure, where permeate passes through the silicon carbide membrane layer and substrate structure, separating suspended solids, oil droplets, emulsions, particles, and bacteria.

This process delivers exceptional removal efficiency without chemical agents, translating to cost savings and environmental benefits that resonate throughout an organization.

The manufacturing process involves sintering ceramic particles at extremely high temperatures—often between 1,800 and 2,000 degrees Celsius.

This creates a rigid, porous structure with precisely controlled pore distribution and exceptional mechanical integrity that simply cannot be replicated with organic materials.

Why Industries Are Making the Switch

Unmatched Durability in Harsh Environments

Silicon carbide ceramic membranes deliver mechanical, thermal, and chemical strength that extends membrane lifetime far beyond what polymeric alternatives can offer, with silicon carbide being the second hardest material in the world after diamonds.

This extraordinary hardness translates to real-world advantages in facilities processing abrasive slurries, corrosive chemicals, or high-temperature fluids.

Ceramic membranes can operate at temperatures up to 350°C and withstand repeated regeneration with aggressive chemical and high-temperature cleanings—conditions that would quickly destroy conventional polymer membranes.

For industries like petrochemicals, mining, and metal finishing, this resilience is non-negotiable.

Superior Chemical and Thermal Resistance

Traditional polymeric membranes face significant limitations when confronted with aggressive cleaning agents or extreme pH conditions.

Polymeric membranes experience decline in both mechanical strength and permeability over time from hypochlorite cleaning agents, increasing manual repair requirements and shortening membrane life.

Ceramic membranes eliminate these concerns entirely. Their inorganic composition allows them to withstand exposure to strong acids, bases, and solvents without degradation.

This chemical robustness permits more aggressive cleaning protocols, reducing fouling, maintaining flux rates, and extending operational periods between cleanings.

Economic Advantages Through Lifecycle Cost Analysis

The initial capital investment for ceramic membrane systems typically runs three to five times higher than polymeric alternatives—a fact that once limited their adoption.

However, ceramic membranes demonstrate lower total cost of ownership due to their longer lifespans of 10-15 years, greater durability, and significantly reduced maintenance requirements.

When operators factor in replacement costs, downtime for repairs, chemical cleaning expenses, and labor requirements, the economic calculus shifts decisively in favor of ceramics.

Ceramic membranes achieve water recovery rates of 98-99% compared to 90-95% for polymeric systems, while reduced fouling leads to lower transmembrane pressure, decreased pumping costs, and reduced chemical cleaning expenses.

Key Applications Driving Market Growth

Water and Wastewater Treatment

Water and wastewater treatment represents approximately 42% of the global ceramic membranes market in 2025, with projected growth at 11.3% CAGR through 2035. This dominance reflects the perfect alignment between ceramic membrane capabilities and water sector needs.

Municipal utilities increasingly specify ceramic systems for surface water treatment plants, particularly in challenging locations prone to seismic activity or flooding.

The mechanical robustness of ceramic elements resists structural fatigue under extreme conditions, ensuring continuous operation when it matters most.

Industrial facilities treating complex effluent streams—from pulp and paper operations to semiconductor manufacturing—leverage ceramic membranes to handle widely varying feed compositions while minimizing costly downtime.

Food and Beverage Processing

Food and beverage processors represent the fastest-expanding vertical at 9.79% CAGR, driven by consumer demand for high-protein drinks, lactose-free milk, and shelf-stable juices.

Dairy operations, in particular, benefit from ceramic membranes’ ability to fractionate milk proteins while withstanding frequent cleaning-in-place cycles.

Wine and beer filtration, fruit juice clarification, and vegetable oil processing all require the precise separation capabilities and hygiene standards that ceramic membranes deliver.

Unlike polymeric membranes which cannot handle frequent sterilization processes essential in food, beverage, and pharmaceutical industries, ceramic membranes maintain performance through repeated high-temperature cleaning cycles.

Pharmaceutical and Biotechnology

Pharmaceutical manufacturing demands absolute purity and consistency—requirements where ceramic membranes excel.

Their stable pore structure ensures reproducible separation, critical for regulatory compliance and product quality. The ability to sterilize membranes at elevated temperatures between batches eliminates cross-contamination risks that plague polymer-based systems.

Biotechnology applications, from cell harvesting to protein purification, increasingly rely on ceramic ultrafiltration.

The chemical inertness of ceramic materials prevents unwanted interactions with sensitive biological molecules, while the mechanical strength withstands the vigorous cleaning required in GMP facilities.

Chemical Processing and Petrochemicals

Dense ceramic membranes enable oxygen separation from air and hydrogen gas separation from mixtures, applications studied for process intensification to reduce energy consumption in petroleum industry operations.

Membrane reactors utilizing oxygen-permeable ceramics represent a cutting-edge approach to improving efficiency in chemical synthesis and fuel processing.

Solvent recovery, catalyst separation, and process stream purification all benefit from ceramic membranes’ resistance to organic solvents and high-temperature operation.

As chemical manufacturers pursue greener processes and circular economy principles, ceramic filtration technology provides essential enabling capabilities.

Environmental and Sustainability Benefits

Beyond performance metrics, ceramic membranes align with the sustainability imperatives driving modern industrial strategy.

Ceramic membranes achieve higher hydrophilicity levels than polymeric alternatives, providing higher water fluxes and significantly fewer membrane fouling problems. This translates to reduced chemical consumption for cleaning and lower energy requirements for maintaining target flux rates.

The extended lifespan of ceramic membranes—often exceeding 15 years compared to 3-5 years for polymers—dramatically reduces waste generation.

At end-of-life, the inorganic ceramic materials can be recycled or disposed of without releasing toxic compounds, unlike many polymer membranes containing plasticizers or other additives.

Water reuse applications benefit particularly from ceramic technology. Facilities can treat and recycle process water that would otherwise require disposal, reducing both freshwater consumption and wastewater discharge volumes.

This capability proves increasingly valuable as water scarcity intensifies globally and regulatory standards tighten.

Overcoming Implementation Challenges

Despite compelling advantages, ceramic membrane adoption faces practical hurdles. The higher upfront capital requirement demands careful justification, particularly in organizations focused on short-term financial metrics.

Successful implementation requires educating stakeholders on lifecycle economics and demonstrating payback periods through detailed cost modeling.

System design differs from polymeric installations. Ceramic modules are heavier and require robust support structures.

The higher transmembrane pressures typical in ceramic cross-flow systems necessitate pumps rated for the operating conditions. However, these engineering considerations are well-understood, and experienced integrators routinely address them during design.

Manufacturing capacity expansions and economies of scale, particularly from producers in China, have progressively reduced ceramic membrane prices in recent years, narrowing the cost gap with polymeric systems.

As production volumes continue increasing to meet surging demand, further price reductions appear likely.

The Path Forward

The trajectory is clear: ceramic membranes are transitioning from niche technology to mainstream solution across industrial filtration applications.

Recent landmark projects like xAI’s world’s largest ceramic membrane bioreactor in Memphis, Tennessee, which will reuse 49.2 million liters of municipal wastewater daily, demonstrate the scalability and confidence major organizations have in the technology.

Innovation continues accelerating. Manufacturers are developing photocatalytic coatings that provide self-cleaning properties, AI-enhanced monitoring systems that predict maintenance needs, and modular designs that simplify capacity expansion.

These advances further strengthen the value proposition while addressing remaining adoption barriers.

For facility managers, engineers, and decision-makers evaluating filtration strategies, the question is no longer whether to consider ceramic membranes, but rather how quickly to transition.

The industries already making this shift—from semiconductor manufacturing to municipal water treatment—are realizing measurable improvements in reliability, efficiency, and sustainability.

Conclusion

Ceramic membranes have earned their position as the gold standard in industrial filtration through demonstrable superiority across the metrics that matter most: durability, chemical resistance, thermal stability, operating efficiency, and total cost of ownership.

As environmental regulations tighten, water becomes scarcer, and industries demand more from their process equipment, the advantages of ceramic technology become increasingly decisive.

The remarkable market growth projections reflect not speculation but recognition of proven performance in thousands of installations worldwide.

Organizations investing in ceramic membrane technology today are positioning themselves for decades of reliable operation, reduced environmental impact, and competitive advantage in an era where filtration capability directly influences business success.

The future of industrial filtration is ceramic—and that future is arriving faster than many anticipated.

Also Read

Inside Modern Ceiling Systems: The Role of Hydrated Lime in High-Performance Ceiling Tiles

Mobile & Modular Batching Plants: The Future of On-Site Concrete Production