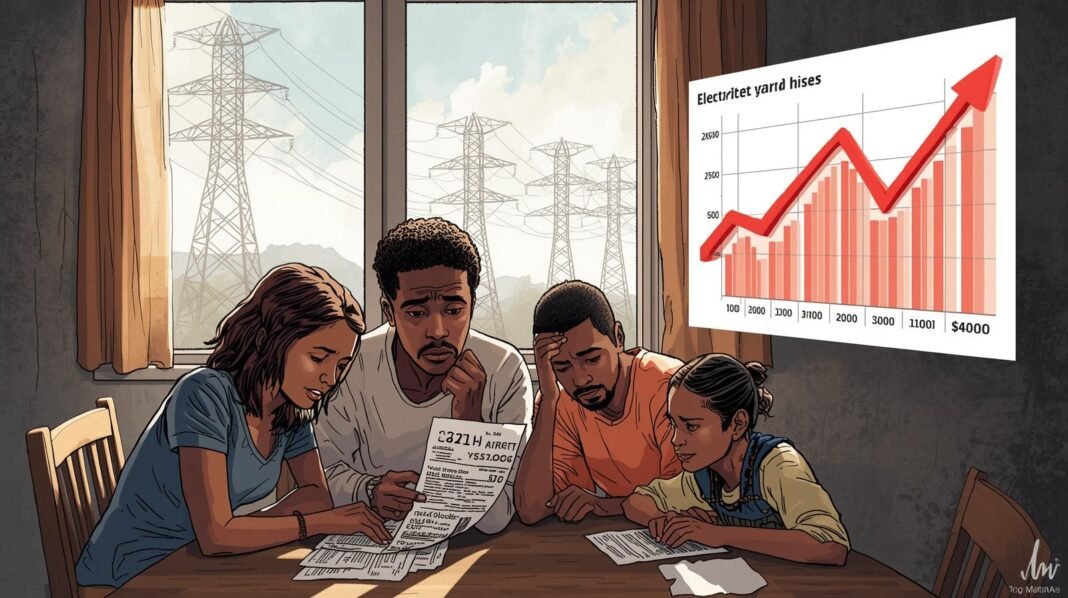

South African households and businesses are bracing for steeper electricity price hikes after the National Energy Regulator of South Africa (NERSA) admitted to a major error in its January tariff determinations.

The regulator confirmed that a miscalculation in depreciation and regulatory asset base (RAB) figures led to an underestimation of Eskom’s revenue needs — an oversight now set to cost consumers billions of rand in additional charges.

A Costly Error Uncovered

In January 2025, NERSA approved tariff increases for Eskom of 12.74% for 2025/26, 5.36% for 2026/27, and 6.19% for 2027/28.

These figures were meant to balance Eskom’s financial recovery with consumer affordability.

However, Eskom later challenged the determination, arguing that the regulator had undervalued its cost base by more than R100 billion.

Following a review, NERSA conceded it had made data input mistakes, particularly in calculating depreciation and handling Eskom’s regulatory asset base.

The error, regulators said, resulted in Eskom being short-changed on allowable revenue.

Settlement With Eskom

To resolve the dispute, NERSA and Eskom reached a confidential settlement worth R54 billion, spread over the three-year Multi-Year Price Determination (MYPD6) period.

While this figure is lower than Eskom’s initial R107 billion claim, it still represents a significant adjustment.

The knock-on effect is that future tariff increases will be steeper than originally announced:

| Financial Year | Original Increase | Revised Increase |

|---|---|---|

| 2025/26 | 12.74% | 12.74% (unchanged) |

| 2026/27 | 5.36% | ~8.76% |

| 2027/28 | 6.19% | ~8.83% |

In practical terms, this means that a household paying R2,000 per month for electricity in 2025 will see their bill rise by nearly R175 more per month in 2026 compared to what was expected under the original determination.

Consumers Left in the Dark

For many South Africans, the revelation has been met with frustration. Rising electricity tariffs, combined with persistent load shedding, fuel a growing sense that households are being asked to pay more while receiving less.

Energy analysts warn that the revised hikes will further squeeze already cash-strapped consumers and small businesses.

“Errors of this nature erode public confidence in the regulator,” said one Johannesburg-based energy economist. “South Africans are effectively paying for a miscalculation that should never have happened.”

Eskom’s Position

Eskom, which is saddled with more than R400 billion in debt, maintains that cost-reflective tariffs are critical to stabilising its finances and ensuring investment in infrastructure.

The utility has argued that the revised increases are necessary for long-term sustainability, even as it struggles with operational inefficiencies and declining generation capacity.

What Happens Next

NERSA has assured the public that corrective measures are being introduced to prevent similar mistakes in future tariff reviews.

The regulator emphasised that no extra increases will be implemented in the current financial year (2025/26), with the adjustments phased in from April 2026.

However, consumer groups are already mobilising to challenge the revised hikes, warning that South Africans are reaching the limits of affordability.

Some municipalities may also struggle to absorb the higher wholesale tariffs, leading to further cost pressures at the local level.

The Bottom Line

NERSA’s calculation blunder has effectively locked South Africans into higher-than-expected electricity costs for the next two years.

While Eskom insists the adjustments are vital for its survival, the real burden will be felt by households and businesses already under financial strain.

With another tariff shock on the horizon in 2026, South Africans face a difficult question: how much more can they afford to pay for power in a system that continues to underdeliver?

Also Read

Capitec Dethrones FirstRand: What the Challenger Bank Is Getting Right

U.S. Economy Expands 3.3% in Second Quarter, Government Reports